The August 2024 downtown Minneapolis real estate market saw an increase in new listings but experienced a significant drop in pending and closed sales, with homes selling faster yet at slightly lower prices per square foot, indicating a mixed market with both opportunities and challenges for buyers and sellers.

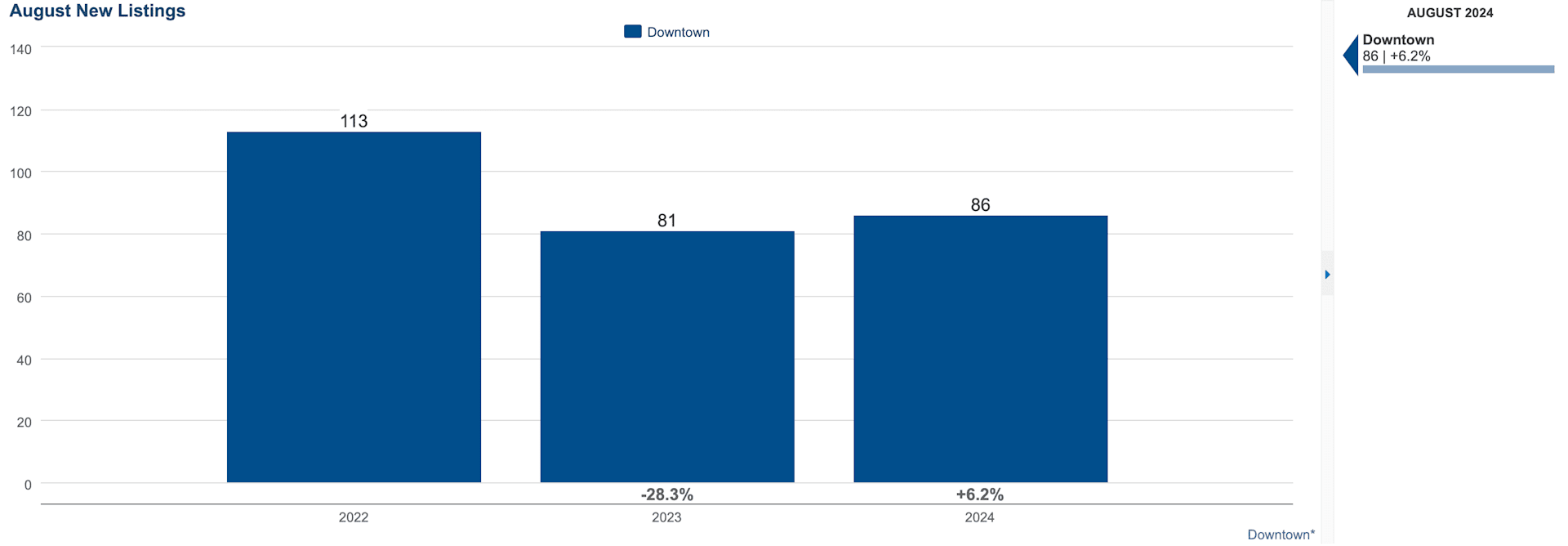

New Listings: New listings increased by 6.2%, with 86 new properties hitting the market in August 2024. This rise in inventory means more options for buyers, offering a greater variety of homes to choose from. For buyers, this can be a great opportunity to explore a wider selection of properties and potentially find better deals. Sellers, on the other hand, might face more competition with more homes on the market, but the overall demand remains steady, keeping the market balanced.

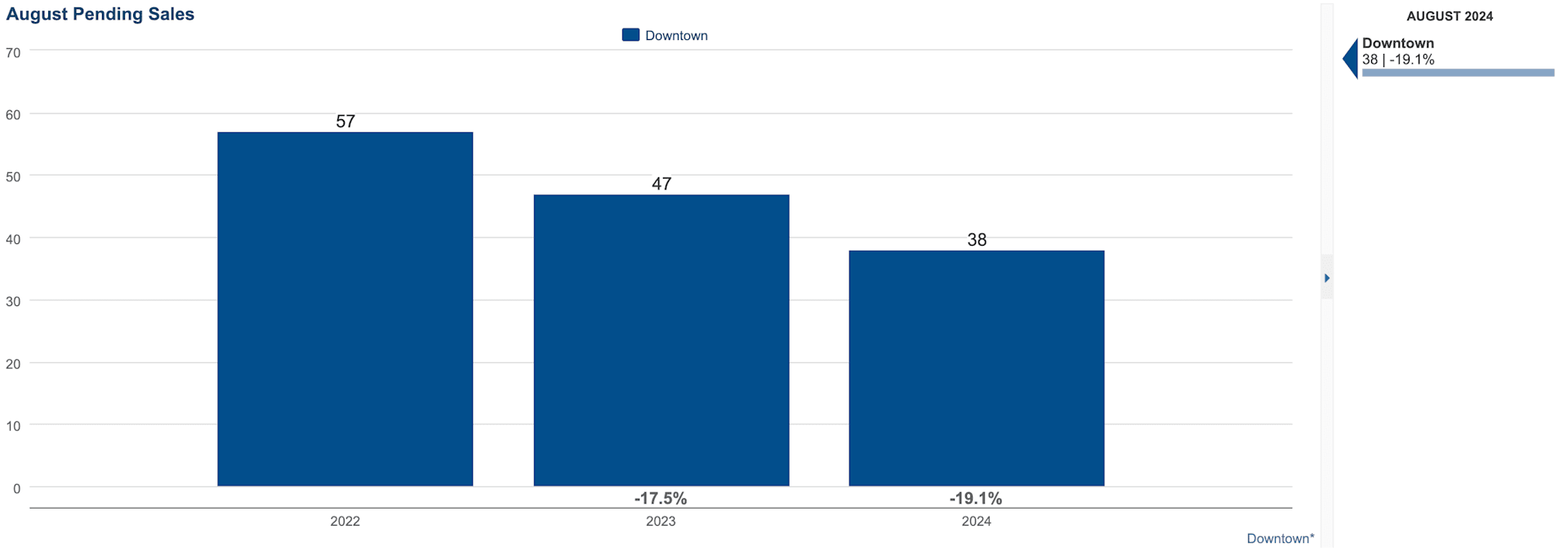

Pending Sales: Pending sales dropped by almost 20%, which could suggest several things about the current market. For buyers, this decrease might indicate some hesitation or caution in committing to a purchase, possibly due to economic uncertainty or changes in market conditions. Sellers may need to be aware that properties might take longer to move from offer to contract, signaling the importance of strategic pricing and marketing to attract serious buyers. This dip in pending sales could also suggest that while there are more listings, fewer are making it to the final stages of the sale process, indicating a potential slowdown or adjustment period in the market.

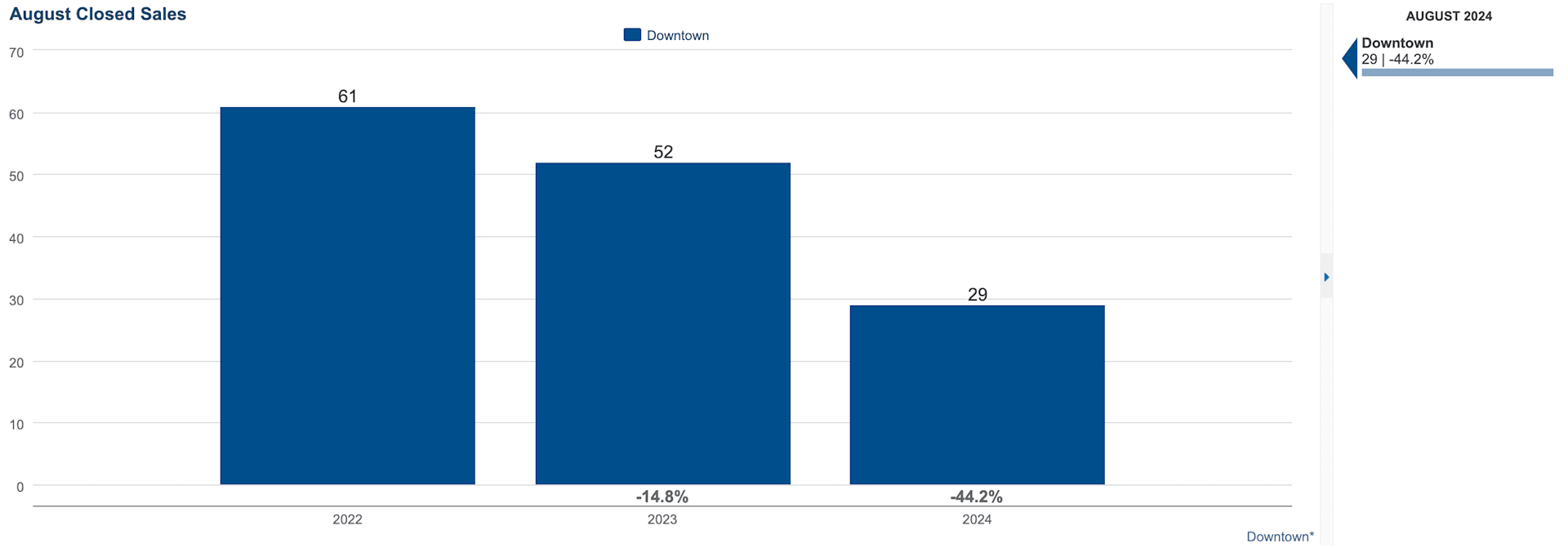

Closed Sales: Closed sales decreased significantly by 44.2%, with only 29 closings in August. For buyers, this could mean less competition once an offer is made, as fewer transactions are being completed. However, for sellers, this significant drop highlights the importance of setting realistic expectations and pricing properties competitively to attract buyers in a slower market. This decrease could reflect the lingering effects of reduced pending sales earlier in the summer, suggesting that the market is currently experiencing a cooling-off period.

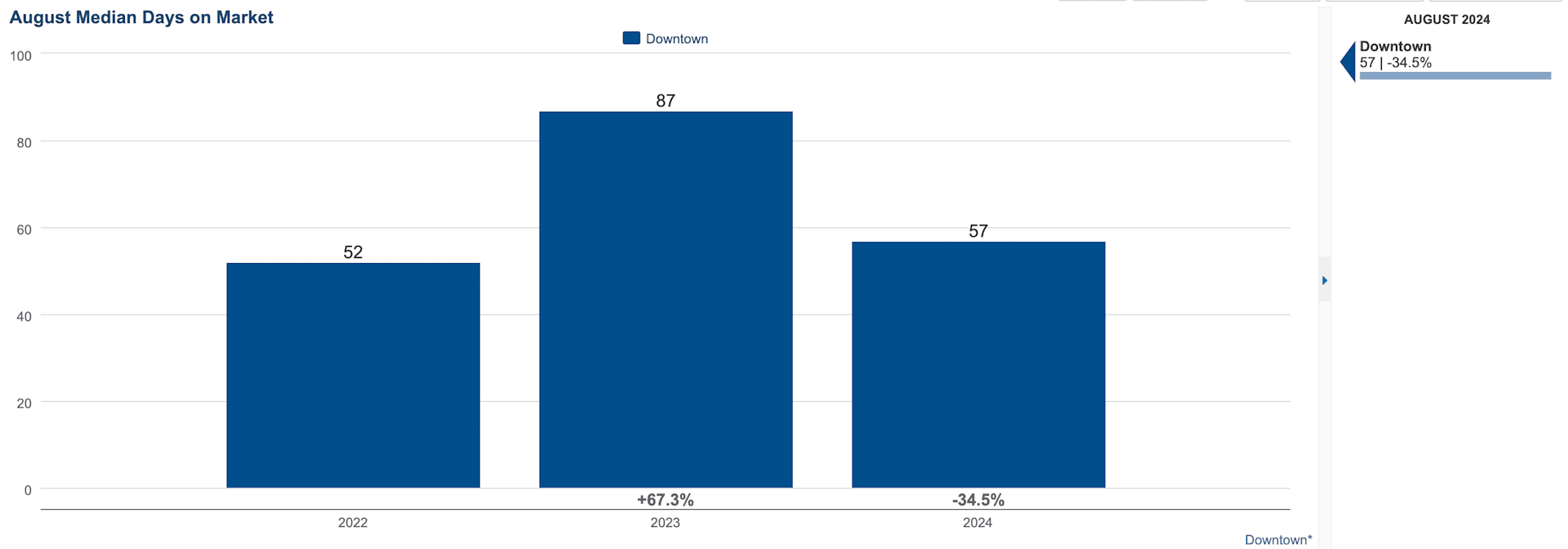

Median Days on Market: The median days on market plummeted by about 34.5% to just 57 days. This decrease is a positive sign for the market, as it indicates that homes are selling more quickly once they are listed. For buyers, this suggests a need to act promptly when finding a suitable property, as homes are moving off the market faster. For sellers, this is encouraging news, as it implies that the market is still active and that well-priced properties are attracting attention and selling efficiently, reducing holding costs and increasing turnover.

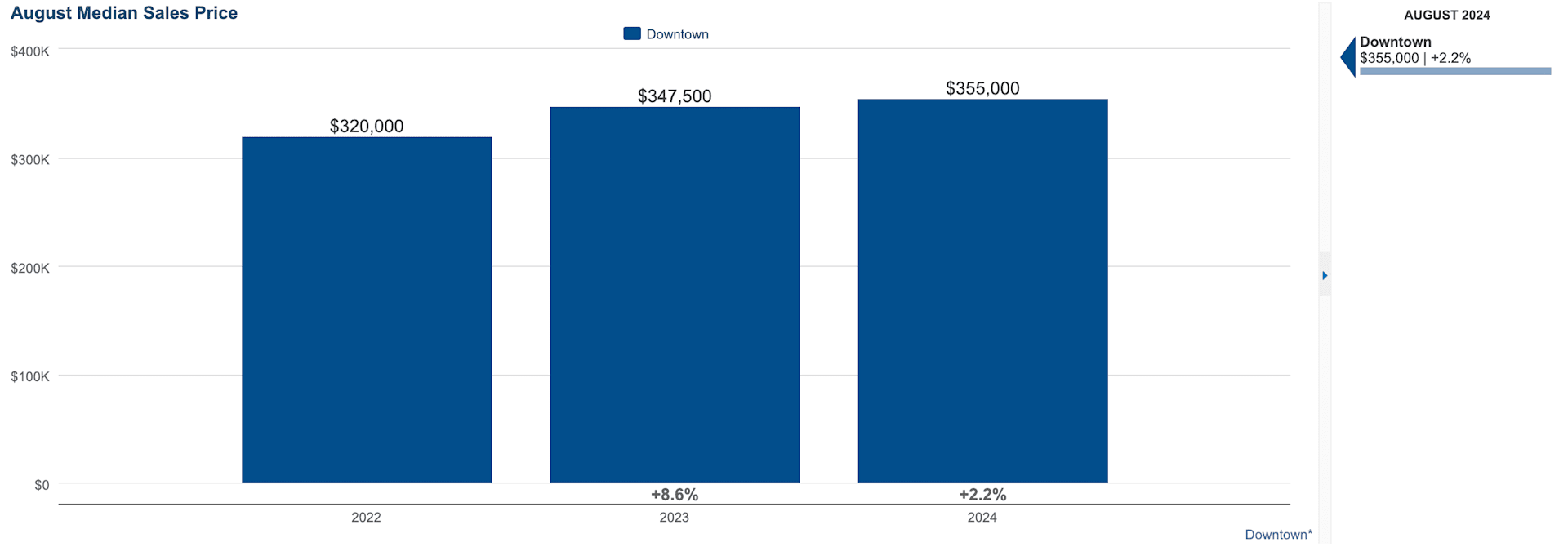

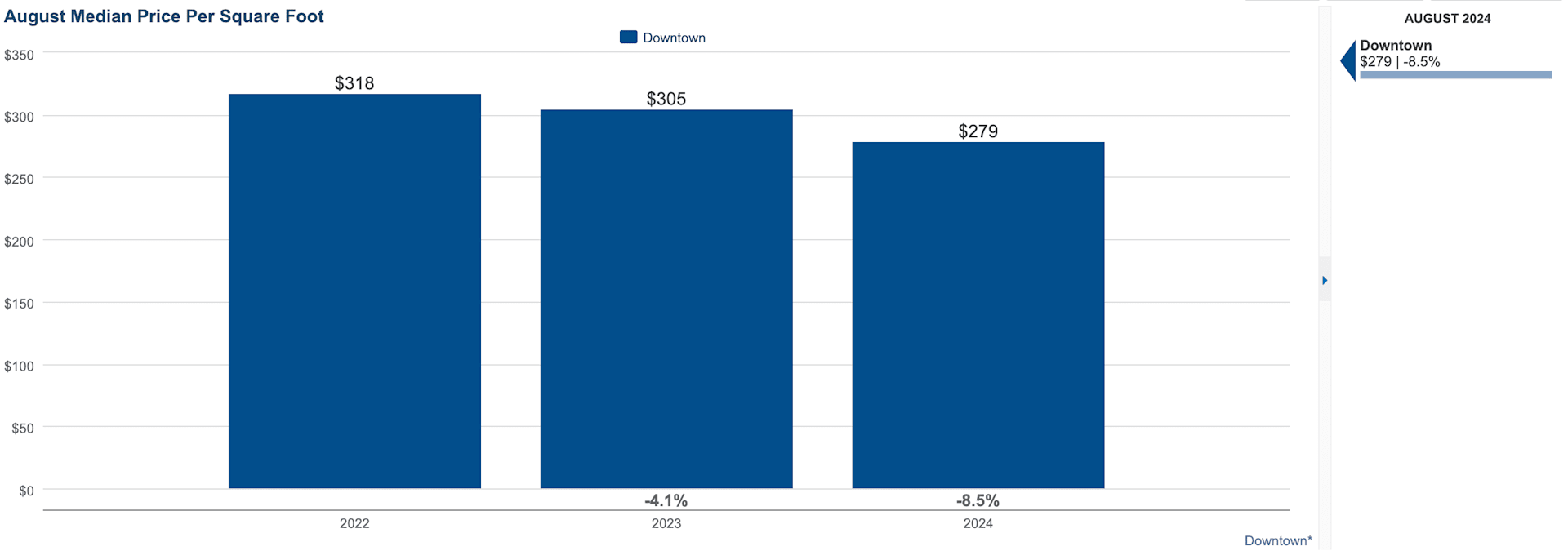

Median Sales Price and Price per Square Foot: The median sales price rose slightly by just over 2% to $355,000, while the median price per square foot fell by 8.5% to $279. For buyers, the slight increase in the median sales price coupled with a decrease in price per square foot suggests that while overall property values are holding steady, there could be opportunities to find deals on larger homes or properties offering more space for the price. Sellers might need to be mindful of this trend and consider that while they can still achieve solid overall sales prices, there may be downward pressure on the value per square foot, possibly reflecting a shift in buyer preferences or market demand for different types of properties.

Market Insights:

- For Buyers: Downtown Minneapolis offers a variety of new listings, but the market is showing signs of a slowdown with fewer pending and closed sales. Act quickly on desirable properties, but be aware of the broader market conditions which might provide leverage for negotiation.

- For Sellers: With a significant decrease in closed sales, it’s crucial to price properties competitively and market them effectively. The reduced days on market is a positive indicator that well-presented homes can still sell quickly, even in a cooling market.

- For Investors: The mixed signals in the market, such as the slight increase in sales prices but decrease in price per square foot, suggest a need for careful analysis and strategic investment. There could be opportunities to purchase properties that offer more space at a better value, but it’s important to consider long-term market trends and the potential for further shifts.

Downtown Minneapolis remains a dynamic market, adapting to changing conditions while still offering opportunities for buyers, sellers, and investors.

REACH OUT TO DISCUSS HOW THESE NUMBERS AFFECT YOUR MARKET TIMING AT [email protected]

Data retrieved from the NorthStarMLS via map of Downtown Minneapolis Neighborhoods including: Loring Park, Elliot Park, Downtown West, Central Minneapolis, North Loop, East Town, Mill District, Nicollet Island, St. Anthony West, and Marcy-Holmes.

HAVE QUESTIONS ABOUT DOWNTOWN MINNEAPOLIS OR SURROUNDING REAL ESTATE MARKETS?

Contact our team by call, email, or submitting a form at: https://lynnburnrealestate.com/