The downtown Minneapolis real estate market in June 2024 exhibited several notable changes compared to June 2023, reflecting dynamic shifts with significant implications for buyers, sellers, and investors.

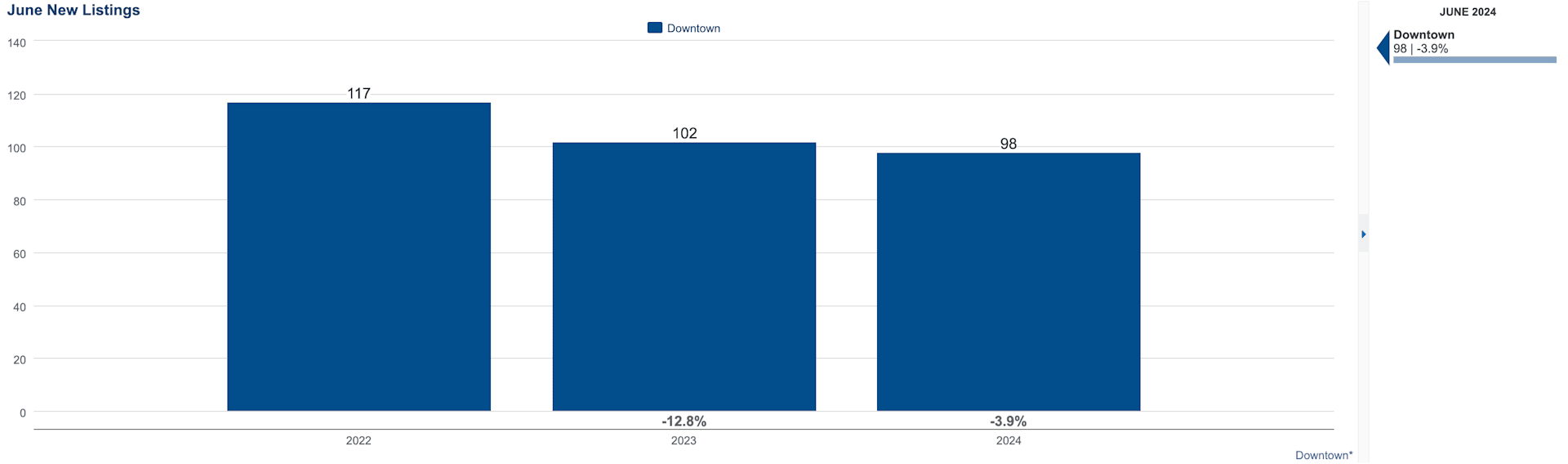

Slight Decrease in New Listings: New listings decreased by about 4%, holding relatively stable. This slight reduction in inventory suggests a tighter market where fewer homes are available for buyers. This stability could indicate that homeowners are holding onto their properties, possibly due to less urgency to sell.

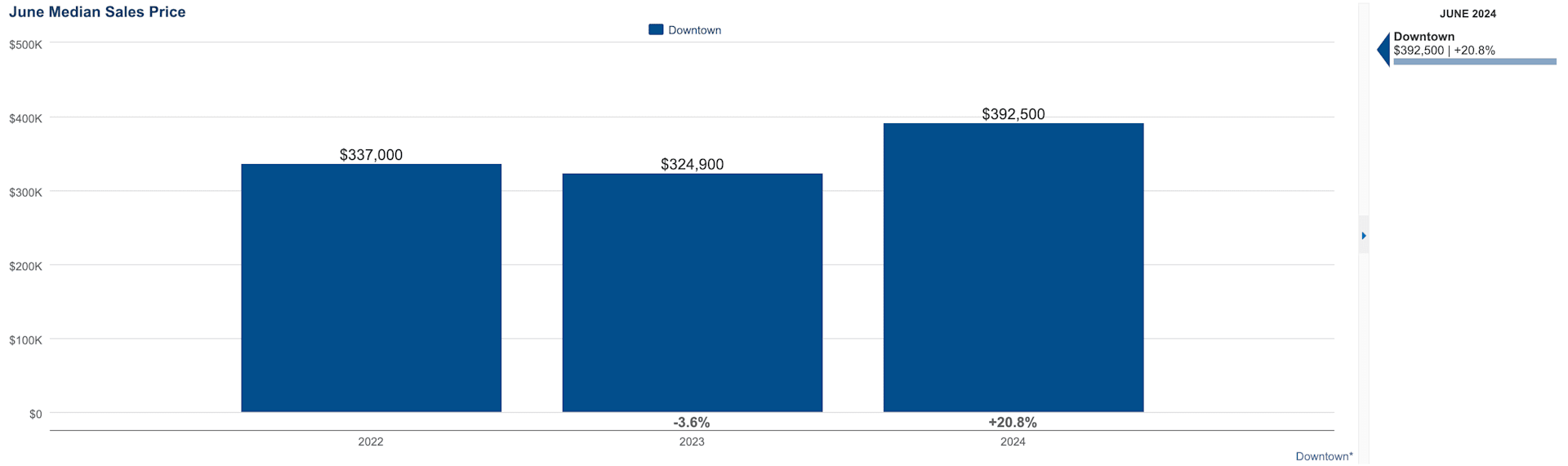

Surge in Median Sales Price: The median sales price surged nearly 21%, soaring to $392,500 across all listings in the downtown Minneapolis market. This substantial increase indicates a robust demand for homes in the area, and luxury to ultra-luxury listings entering the resale market further affects this figure.

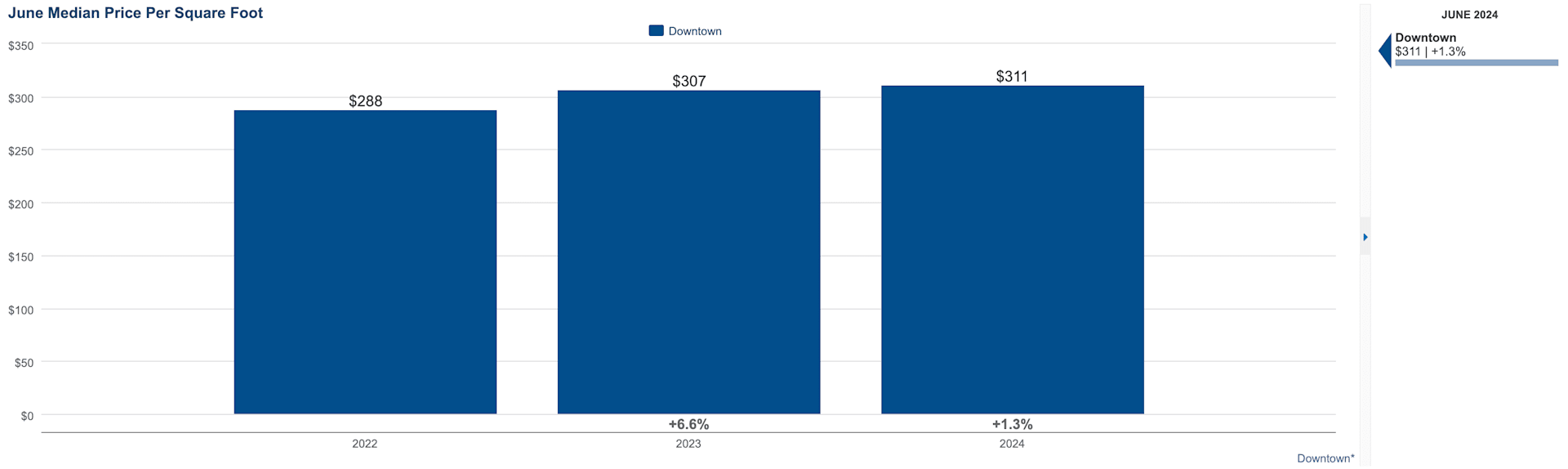

Increase in Median Price per Square Foot: The median price per square foot rose about 1.3% to $311/sq ft. This modest increase, alongside the significant rise in overall median sales price, suggests that while homes are becoming more expensive overall, the value attributed to the size of properties is also appreciating slightly. This trend can be appealing to buyers focused on investment potential and long-term value.

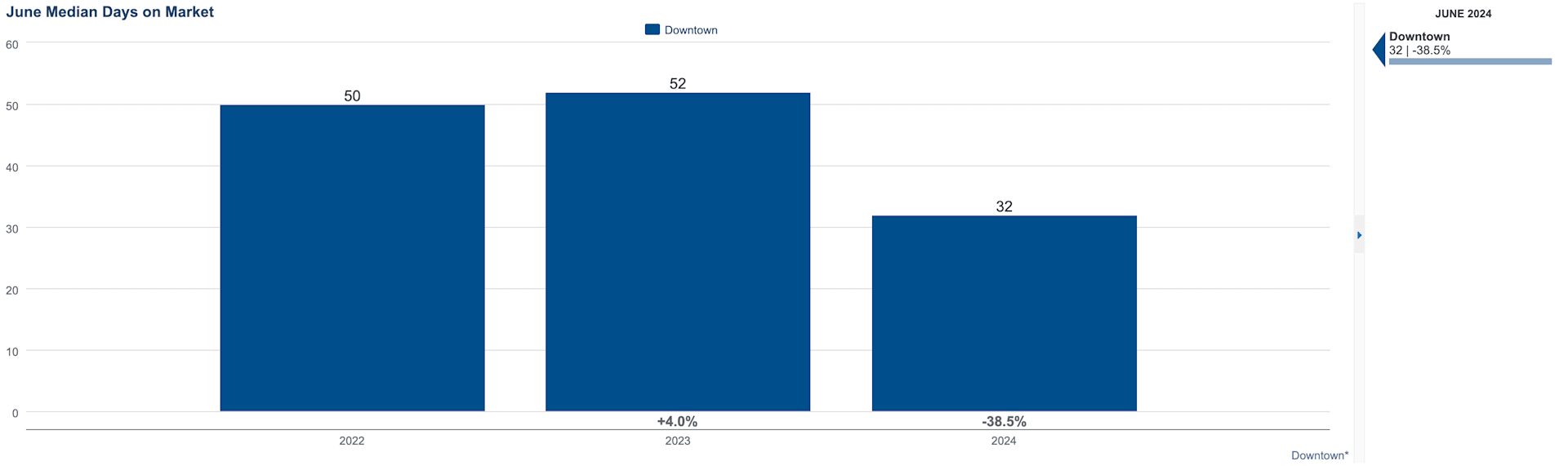

Reduction in Median Days on Market: Median days on market plummeted to nearly one month, a decrease of 38.5%. Homes are selling much faster, indicating strong buyer interest and a highly competitive market. Sellers benefit from quicker transactions, which can reduce holding costs and provide faster access to capital. However, buyers may need to act quickly to secure desired properties.

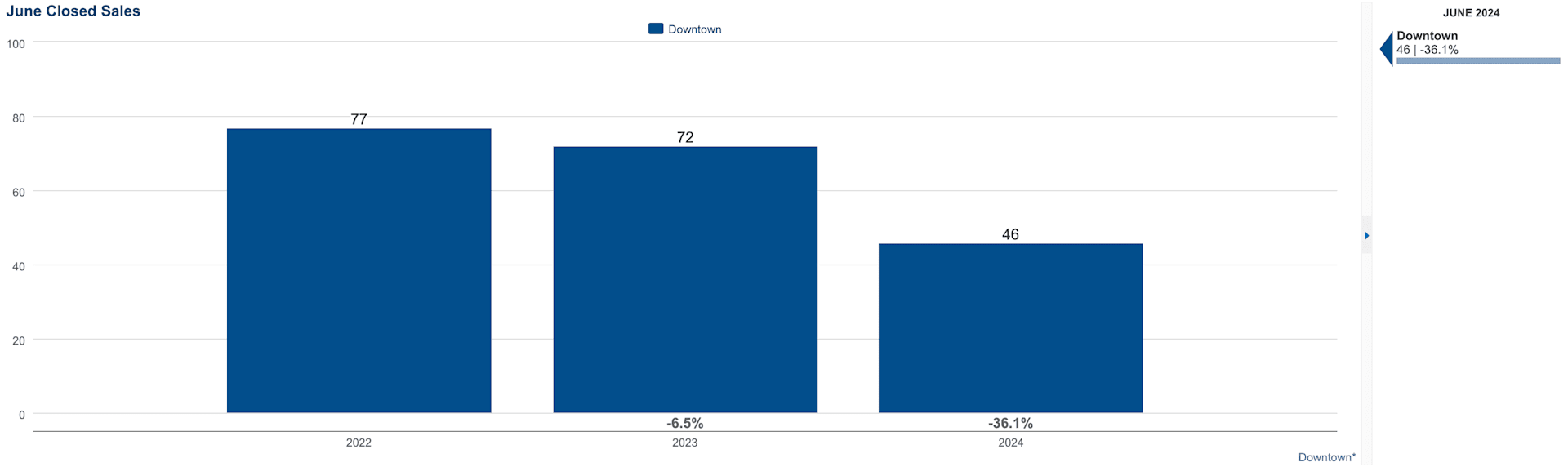

Decrease in Closed Sales: There were just 46 closed sales, 36% less than this time last year. This decline suggests that while demand remains strong, the market's higher prices and reduced listings are impacting overall sales volume.

Overall Market Implications:

-

Buyers: The surge in prices and reduced inventory make the market more challenging, requiring swift action and potentially higher budgets to secure properties.

-

Sellers: The environment is favorable with soaring prices and quicker sales, providing opportunities for significant returns on property sales. However, the reduced number of transactions suggests that strategic pricing and timing are crucial.

-

Investors: The rise in median sales price and stable price per square foot present attractive long-term investment opportunities. The quick turnover of properties indicates a healthy market, though the reduced number of transactions calls for careful market analysis.

The downtown Minneapolis real estate market remains vibrant, characterized by high demand, rising prices, and rapid sales for desirable properties, creating a competitive landscape for all market participants.

REACH OUT TO DISCUSS HOW THESE NUMBERS AFFECT YOUR MARKET TIMING AT [email protected]

Data retrieved from the NorthStarMLS via map of Downtown Minneapolis Neighborhoods including: Loring Park, Elliot Park, Downtown West, Central Minneapolis, North Loop, East Town, Mill District, Nicollet Island, St. Anthony West, and Marcy-Holmes.

HAVE QUESTIONS ABOUT DOWNTOWN MINNEAPOLIS OR SURROUNDING REAL ESTATE MARKETS?

Contact our team by call, email, or submitting a form at: https://lynnburnrealestate.com/